Whether you are remediating (fixing) accessibility issues on your current site, or taking on a site redevelopment project to improve accessibility, costs can add up. But there is good news! Some US business owners may be eligible for a tax credit to help offset these costs.

When the Americans with Disabilities Act (ADA) was signed in 1990, many brick-and-mortar store and facility owners had to do a lot of work to get into compliance. Ramps had to be added, signage purchased and installed, bathrooms remodeled. To help offset those costs, Congress created the Disabled Access Credit. This credit still exists, and the Internal Revenue Service (IRS) allows these credits for any work related to your website that improves its accessibility.

Who is eligible?

Businesses and individuals (but not nonprofits) are eligible to claim the Disabled Access Credit if they:

- Had gross receipts for the preceding tax year that did not exceed $1 million, OR

- Had no more than 30 full-time employees during the preceding tax year

Gross receipts are reduced by returns and allowances made during the tax year, so your total revenue may have been over $1M. And an employee is considered full time if they are employed at least 30 hours per week for 20 or more calendar weeks in the tax year.

What projects qualify?

The expenditure has to help move your business toward compliance with ADA and improve access for persons with disabilities. The expenditure that you claim for this credit can’t be claimed as a deduction in figuring taxable income, capitalized, or used in figuring any other credit.

Almost any project that improves the accessibility of your website qualifies for this tax credit. This would include a major redevelopment project (as long as accessibility is clearly a part of the project goals), accessibility remediations, and accessibility audits.

How much is the credit?

This is a non-refundable tax credit. It reduces the amount of tax you owe, but doesn’t give you any tax refunds.

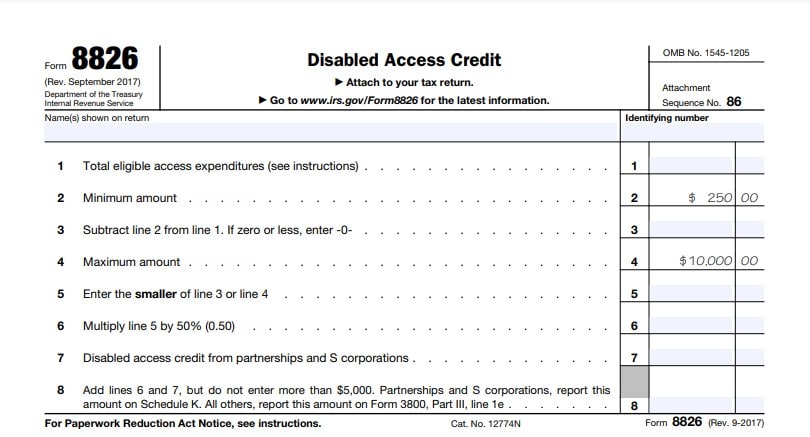

The Disabled Access Credit is 50% of your eligible expenditures, that must be at least $250, and may be up to $10,000. For instance (assuming your business is eligible as described above), if you pay $10,000 for website accessibility remediations, you could qualify for a $5,000 tax credit.

How do you claim this credit?

You must first pay the full amount to have the work done. Make sure that you get invoices from any vendors that clearly indicate that the work was to improve accessibility, and save those invoices.

When you file your taxes for the year of the expenditure, you claim this credit by filing IRS Form 8826 (PDF download that includes instructions). It’s not required, but recommended that you include your invoices or receipts of payments.

How often can you claim this credit?

Theoretically, you can keep claiming this credit each year. But pay attention to the requirements that include your own eligibility as a business, and whether the expenditure is moving you forward with website accessibility.

Our Accessibility Maintenance Plans help you remove barriers for people with disabilities and meet legal requirements with confidence.

2 responses to “Web Accessibility Tax Credit”

Hi Bet, Ron here from CodeGeek. With regard to this potential IRS tax credit, have you or any of your clients actually filed for this tax credit? Have you ever heard of any pushback? I ask because I’ve read the fine print on form 8826 and it’s not clear to me if applying this credit towards website accessibility would really hold up under an IRS Audit. It would be nice to talk to some folks who have either been audited, or have had pushback on filing the credit and how they navigated that (and if they were successful). I’d love to hear anything you have to share on this topic. Thanks! – Ron

Hi Ron! Yes, we have had clients claim this tax credit for website accessibility improvements, and as far as I know, no one has had any pushback or issues with an audit. Obviously, the more closely related the claimed work is to actual improvements, the better for claiming this. So actual remediations work is definitely solid ground. Audits as long as the information was acted upon (not just a test that is then ignored) should be fine.

We have known folks who claimed the whole cost of a site redevelopment when part of the focus was significant improvements in accessibility. The key for that is making sure that the documents related to the project (the proposal, the contract, the invoices) all mention that accessibility improvement focus, and that the client save those docs in case they are audited.